The Concept of Multiple Income Streams

A trader’s journey often begins with one income source — trading profits. While this seems sufficient in the early stages, the reality is that markets are uncertain, emotionally taxing, and income from trading fluctuates dramatically. Relying solely on trading income is equivalent to building a skyscraper on a single pillar. Creating multiple income streams means diversifying your sources of cash flow so that even if one fails, others continue to support your lifestyle and wealth accumulation. In essence:

Total Income (TI) = Active Income (AI) + Passive Income (PI)

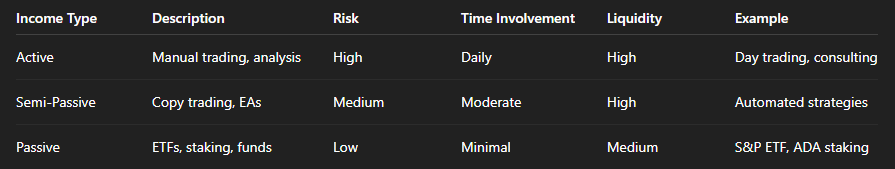

Active vs. Passive Income: Understanding the Difference

Active income is earned through your direct labor or skill. In trading, this could include:

- Manual day trading or scalping

- Freelance financial analysis

- Mentoring or providing trading education

- Managing other traders’ accounts for a commission

Characteristics:

- Requires time, skill, and attention

- Income stops if you stop working

- Typically has high volatility but high short-term potential

Example Formula:

AI = (Hourly Rate) × (Hours Worked) + Performance Bonus

For traders:

Traders = (Average Profit per Trade) × (Number of Trades per Month)

Passive income continues to flow even when you’re not actively working. For traders, it could include:

- Dividends from ETFs or index funds

- Crypto staking and yield farming

- Real estate investment trusts (REITs)

- Profit-sharing from automated strategies

- Insurance or pension funds that accumulate interest

Characteristics:

- Requires capital instead of time

- Grows with compounding

- Provides stability and freedom

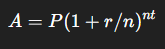

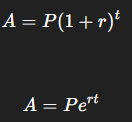

Formula for passive compounding:

Where:

- A = Future Value

- P = Principal (initial capital)

- r = Annual interest rate

- n = Number of compounding periods per year

- t = Number of years

The Psychology Behind Diversification

Many traders view diversification as a distraction. However, financial literacy transforms it into protection. The most dangerous mindset in trading is believing you’ll “always win.” Diversification protects against:

- Market Risk — when volatility or macroeconomic events hit your trading strategy

- Emotional Risk — over-trading due to pressure from lack of alternative income

- Liquidity Risk — when your only capital is trapped in open trades

Think of income streams as insurance policies for your financial life. Just as traders use stop-loss orders to protect their accounts, multiple income streams protect your life balance.

Building Passive Streams: The Core Pillars

ETFs (Exchange-Traded Funds)

ETFs combine diversification and liquidity. By investing in an ETF, a trader buys exposure to a basket of stocks, bonds, or commodities — spreading risk across multiple assets.

Advantages for Traders:

- Low cost (expense ratios often <1%)

- Passive growth with dividend income

- Simple to automate through brokerage platforms

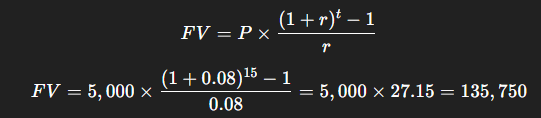

Example:

If you invest $5,000 monthly in an S&P 500 ETF returning an average of 8% annually for 15 years:

Index funds mirror a specific market index, like the S&P 500 or NASDAQ-100. They’re perfect for traders who want long-term compounding without emotional exposure to market swings.

Why it works:

Index funds benefit from Dollar-Cost Averaging (DCA) — investing a fixed amount regularly regardless of market price.

Formula:

Average Cost per Share = [Total Amount Invested ] / [Total Shares Purchased]

This strategy neutralizes volatility risk. When markets fall, you buy more shares; when they rise, your existing shares gain value.

Key advantage for traders:

DCA eliminates the emotional bias of timing the market — a discipline that mirrors professional trading risk control.

Crypto Staking

Crypto staking allows traders to earn passive rewards by locking tokens in a blockchain network. It’s essentially earning interest for providing liquidity or validation to the network.

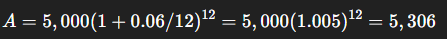

Example:

If you stake 5,000 ADA at a 6% annual reward rate compounded monthly:

You’d earn $306 in one year without any market exposure. But unlike ETFs, staking involves market volatility + token risk, so it’s wise to stake only 10–20% of your long-term crypto portfolio.

Insurance & Pension Funds

These are often overlooked by traders because they appear “too traditional.” Yet, they play a crucial role in financial stability and risk protection.

Insurance funds (life or investment-linked) create capital guarantees that complement trading risk. Pension funds build long-term compounding and ensure financial independence beyond active trading years.

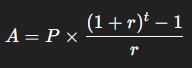

Formula for future pension value:

The Synergy Between Active and Passive Income

The ideal trader doesn’t abandon active trading — they use it as a generator to fund passive investments.

Strategy:

Trade → Profit → Allocate → Compound

For example:

- 70% of profits reinvested into trading capital (growth)

- 20% allocated to ETFs/index funds (wealth stability)

- 10% reserved for staking or insurance savings (protection)

This “Profit Allocation Matrix” balances risk, growth, and security.

Mathematical Framework: Balancing Growth and Stability

To evaluate your income stability as a trader, you can measure the Passive Income Ratio (PIR):

PIR = [Passive Income] / [Total Monthly Expenses] × 100

Goal:

- PIR < 25% → Financially fragile

- PIR 25–75% → Transition zone

- PIR > 100% → Financial independence

Example:

If you earn $1,000/month from staking and ETFs, and your monthly expenses are $800:

PIR = (1,000 / 800) × 100 = 125%

You’ve reached financial independence — your assets now fund your lifestyle.

Compounding: The Silent Accelerator

Compounding is the most powerful force in passive income creation. Einstein famously called it the “eighth wonder of the world.” For traders, compounding is not only financial but psychological — it reinforces discipline.

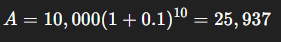

Compound Growth Formula (annualized):

Example:

A $10,000 investment at 10% annual return for 10 years:

That’s a 159% growth through time alone — no leverage, no charts, no sleepless nights.

Integrating Trading Into the Wealth Ecosystem

Active trading income can be unpredictable, but if structured properly, it becomes the catalyst for a broader financial ecosystem.

Step 1 – Define Your Capital Flow

- Primary Source: Trading Profits

- Secondary Flow: Divert 30–40% of profits monthly into long-term investments

Investment Allocation = (Trading Profit) × α

where

0.3 ≤ α ≤ 0.4

Step 2 – Create Asset Buckets

- Short-Term (0–1 year): Emergency fund, cash reserves

- Mid-Term (1–5 years): ETFs, staking, high-yield savings

- Long-Term (5+ years): Index funds, insurance, real estate

Step 3 – Automate Reinvestment

Use auto-investment plans, robo-advisors, or staking platforms that compound automatically.

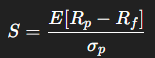

Risk & Return Optimization

Each income source has its expected return (ER) and risk (σ). You can evaluate total portfolio performance using the Sharpe Ratio:

A diversified portfolio with ETFs, staking, and trading income can increase the Sharpe Ratio — higher returns for the same or lower risk.

.png)